Old Age Allowance Program in Bangladesh: A Regulatory Overview

Author: Shahriar Rabab

The Old Age Allowance in Bangladesh is part of the Social Safety Net Program implemented under the Ministry of Social Welfare. The Program aims to provide financial assistance to elderly citizens who are 65 years of age or older and do not have a regular source of income to improve their living conditions and ensure a basic level of financial security for the elderly population in the country.

Over the years, the Old Age Allowance Program has gone through several changes and modifications to suit the changing economic condition and an exponential rise in the number of recipients. Even then, there remain challenges and barriers to implementing the program at the root level.

Current Scenario of Old Age Allowance in Bangladesh

The Old Age Allowance program was first introduced in 1998 with 5 male and 5 female recipients from each ward and Union Parishad. Initially, the monthly amount was 100 BDT to be disbursed quarterly (Ministry of Social Welfare, 2022).

The first major change in the program was brought in 2009 which was to double the number of recipients by 2021. It was also the year when the allowance amount was increased to 300 BDT. The amount was again increased to 500 BDT in 2016 and has since remained the same until this year. In the 2021-22 fiscal year, the government disbursed 34,445.42 Crore BDT to 5.7 million recipients (Ministry of Social Welfare, 2022).

The new proposed allowance will see an increment of 100 BDT to 600 BDT. Even then, the allowance amount is not on par with the economic change in the country. In most cases, the allowance is the only source of income for the recipients with no other secondary support source. In the current economic situation with the rising cost of living, a meager amount of 600 BDT is not enough to support a person for a month.

However, the problem does not lie with the allowance amount only. From the selection process to the disbursement, the existing framework has some key issues which make accessing the allowance a rigorous process.

The Regulatory Framework of Old Age Allowance in Bangladesh

The Old Age Allowance of Bangladesh was initially administered through a traditional offline process. For ease of operation and management, the entire program has been divided into several stages.

The Ministry of Social Welfare acts as the overseer of the entire program. Under the guidance of the ministry, there are several sub-committees operating at the national and district levels. At the district level, the committee works under the folds of the District Magistrate. The Social Welfare Officer (SWO) of each district handles the operation at Upazila, Ward, and Municipality levels. Beyond the regulatory stakeholders, there are the Member of Parliament, Chairman (UP), Commissioner (Ward), and member of civil society who aids in the process (Ministry of Social Welfare, 2013). The SWO is the main contact point at the root level and works with the additional stakeholders to vet and manage the list of allowance beneficiaries in a locality.

Currently, the application process for the old age allowance follows a hybrid approach. Potential recipients can sign up for the allowance through the MIS Portal opened to register new beneficiaries. However, applications through the portal are not available throughout the year. The portal’s intermittent and unannounced openings have led to a remarkably low number of online applications for the Old Age Allowance.

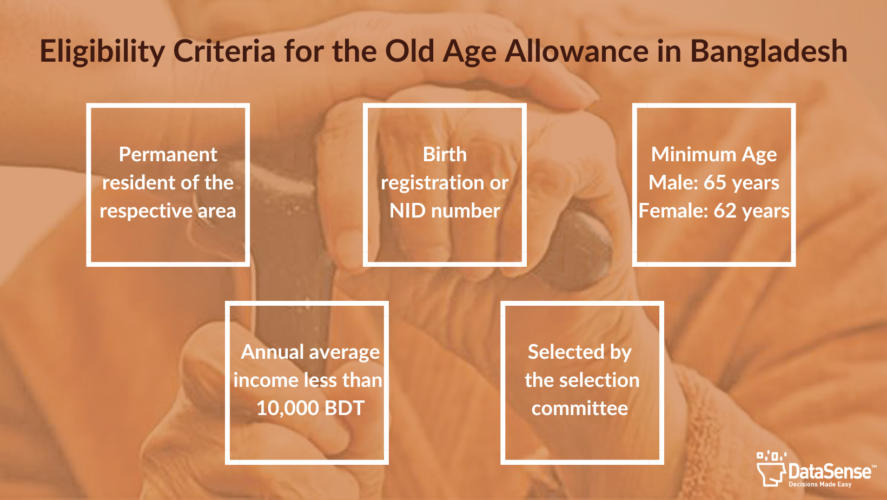

The eligibility criteria for the Old Age Allowance have been revised several times to reach the most vulnerable elderly population in the country. Currently, the criteria are as follows-

- The applicant must be a permanent resident of the respective area.

- Birth registration or national identification number must be available.

- For males, the minimum age should be 65 years, and for females, the minimum age should be 62 years. The government may consider the specified age limit from time to time.

- The annual average income of the applicant must be below 10,000 (ten thousand) BDT.

- The selection committee must choose the candidate.

The majority of the beneficiaries are registered at the root level. The registration process happens through the external stakeholders (MP, Chairman, and Ward Commissioner) who undertake widespread awareness campaigns in their respective localities. The entire application process is delegated to the office of the SWO. A potential beneficiary will need to have the following documents to complete the application process for the allowance.

- Personal identification details (NID/Birth Registration Certificate)

- Land ownership records (Land deed, Khatiyaan, Mutation document)

- Educational certificates if applicable

- Detailed information of the nominee (NID/BRC, Educational Certificate)

- Bank account details (To be opened after directives from the SWO)

- Passbook maintenance (By the relevant banks)

- Checkbook maintenance (In case of physical withdrawal from a bank)

The office of the SWO will communicate with all the relevant stakeholders to update the central database of the recipients.

One of the contributing factors behind the unsatisfactory outcome of the online application process pertains to a lack of digital literacy. (CPD, 2023). A large portion of the recipients are in rural areas which only makes it more challenging for them to follow the online route. The absence of internet access or smartphones significantly impedes the process, and it is important to note that the challenges extend beyond the application process alone.

The Allowance Disbursement Process

Initially, the allowance was disbursed through the partner banks of the Program and their agent banking system in different localities. However, in 2017, the government took a revolutionary decision to entirely digitize the disbursement process.

Previously, the recipients or their nominees could only withdraw the allowance from the designated branch of the beneficiary bank. With the addition of MFS partners like bKash and Nagad, the government was able to implement the G2P Payment program to reduce much of the bureaucratic process involving several financial stakeholders.

Similarly, to the challenges faced in the application process, the issue of accessibility also persists in the adoption of Mobile Financial Services (MFS) for the beneficiaries. Frequently, beneficiaries lack the necessary expertise to operate an MFS account or face barriers in accessing smartphones, further hindering their ability to fully utilize these services.

As the situation stands, the withdrawal of the allowance through MFS and G2P Kiosks is much easier compared to the traditional bank withdrawal. But the lack of knowledge and access to relevant tech makes the beneficiaries dependent on third parties for withdrawals (relatives and MFS agents) which comes with its own challenges (CPD, 2023).

The Existing Regulatory Gap

The entire Old Age Allowance program from inception to disbursement is processed under several overseeing stakeholders. There is also a central database to maintain the information of the beneficiaries. Even then, there are several regulatory loopholes that detriment the overall impact of the program.

The first issue is regarding the beneficiaries. Study shows that around 30% of the beneficiaries under the Old Age Program are not eligible according to the existing regulation (Prothom Alo, 2023). On the contrary, there are about 3.3 million potential eligible beneficiaries who are left out due to budget constraints. The government is spending about BDT 15 billion on these beneficiaries which could be used to bring 1.5 million new actual beneficiaries under the program.

Another issue is regarding the effective allocation of the budget. The government of Bangladesh has proposed a 126,272 Crore BDT budget for the SSNP. However, a majority of this budget is not directed to the poor and vulnerable. A budget breakdown shows that about 59.67% of the budget will be allocated to the non-poor. Among these, 22% will go as pension for 0.8 million retired government employees. Another 11% will go as an interest payment for national saving certificates. All of these issues together pose the need for several regulatory reforms (Daily Star, 2023).

The Way Forward

The current 5.7 million Old Age Allowance beneficiaries are expected to rise to 5.8 million by the end of 2023. While the government has proposed an increment for the new fiscal year, the amount in most cases is not enough. The regulatory reformation should start with elimination of the ineligible beneficiaries from the list and gradually move on to improved allocation, access to DFS, and streamlining the beneficiary inclusion process.

Additionally, the Social Safety Net Program geared towards serving the poor and extreme poor should be separated from the overall safety net program. SSNP was developed to serve the communities who are in dire need of monetary assistance. But regulatory reforms and the addition of non-poor support programs has offset the main goal of SSNP.

The 2023-24 FY budget boasts a sizeable 2.52 percent of GDP allocated for the SSNP. But in reality, only 1.01 percent is being allocated for the extreme poor (Daily Star, 2023). In essence, the entire allocation itself isn’t enough to support the total existing poor people of the country (including the 3 million potential beneficiaries for the old age allowance). Allocating less than half of it to support the extreme poor doesn’t help much to alleviate the problem.

Reference list

Bangladesh raises monthly allowances for the elderly, and widows to bolster the social security net. (2023). bdnews24.com. Available at: https://bdnews24.com/economy/z12rr71zso [Accessed 11 Jul. 2023].

Begum, S. (2018). Old Age Allowance Programme of Bangladesh: Challenges and Lessons. [online] Available at: https://ipcig.org/conference/south-south-learning-event/presentations/Sharifa%20Begum.pdf.

Bribes for old-age allowance: Hold those responsible accountable. (2023). Prothomalo. Available at: https://en.prothomalo.com/opinion/editorial/51yd64ex3w [Accessed 11 Jul. 2023].

Byron, R.K. and Habib, W.B. (2023). Safety Net Budget Fy 2023-24: Spending just 1.01pc of GDP, not 2.52pc. The Daily Star. Available at: https://www.thedailystar.net/special-events/national-budget-2023-24/news/safety-net-budget-fy-2023-24-spending-just-101pc-gdp-not-252pc-3336841 [Accessed 18 Jul. 2023].

G2P Payment Digitization Prologue. (2022). Available at: https://a2i.gov.bd/wp-content/uploads/2022/08/Accelarating-G2P-Payment-Digitization-Lessons-from-the-field.pdf [Accessed 11 Jul. 2023].

Ministry of Social Welfare (2013). Implementation Manual for Old Age Allowance Program.

Ministry of Social Welfare (2022). Madrid International Plan of Action on Ageing (MIPAA) Ministry of Social Welfare People’s Republic of Bangladesh. [online] Available at: https://www.unescap.org/sites/default/d8files/event-documents/Bangladesh_cs2.pdf [Accessed 11 Jul. 2023].

Moazzem, K.G. and Shibly, A.S.A. (2023). Estimating Gap of the Social Safety Net Programmes in Bangladesh How Much Additional Resources Required for Comprehensive Social Inclusion? CPD-Christian Aid Study on Content. [online] Available at: https://cpd.org.bd/resources/2023/05/Presentation-on-Estimating-Gap-of-the-Social-Safety-Net-Programmes-in-Bangladesh.pdf [Accessed 11 Jul. 2023].

![]()